Plan for Profit, One Department at a Time

Do you know what departments or product categories are profitable at your store and, more importantly, what are not? Having a hunch doesn’t count. You need profit and loss statements at the department- or product-category level. Only when you know where your profits lie can you make the best decisions that maximize profitability. In addition, departmental profitability can be an important item on a manager’s report card, whether for the purpose of designing an incentive plan or for measuring his or her effectiveness. Departmental profit and loss statements give you an objective way to judge a department manager’s performance.

The choice of whether to make a departmental or a product category statement is up to you, but it needs to have point-of-sale data. For most people, the department level is sufficient, but eventually, you may want to drill down a bit deeper.

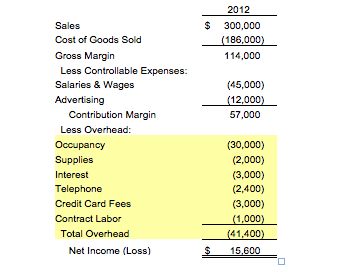

Start with sales and cost of goods sold information for the department you’re analyzing. The gross margin dollars (sales minus cost of goods sold) represent the dollars you have left to spend on all expenses. Next, subtract controllable expenses—usually salaries and advertising. These expenses are under a manager’s control, or would not be there if that department did not exist. Salaries and wages need to include not only selling salaries for the staff that works in that department but also a portion of all the non-selling staff salaries (office, purchasing, cashiers, owners, etc.). The example below shows a departmental profit and loss statement up to the contribution margin point:

The dollars now left are called contribution margin and represent what that department is actually contributing to the overhead of the business. If that department didn’t exist, most, if not all, of those overhead costs would still exist and would have to be taken up by another department.

Next, subtract the department’s share of overhead expenses to find the profit or loss. But what is that share? Sometimes, we can directly attribute expenses to a particular department at a transaction level, but most of the time, the expense is either paid on a store-wide basis (office supplies, for example) or the sheer number of transactions makes the exercise inefficient. In that case, we make an allocation of the total store expense to the department based on some activity measure.

What’s an appropriate activity measure? Here are some standard ways to assign expenses over multiple departments:

- Square footage (occupancy)

- Number of employees and usage (supplies, telephone, etc.)

- Time (salaries)

- Direct attribution (contract labor, travel, etc.)

- Percentage of inventory (interest)

- Percentage of sales (credit card fees)

For example, if the department we’re examining occupies 20 percent of the retail space's square footage, then allocate 20 percent of the occupancy costs (rent, repairs and maintenance, insurance, etc.) to your departmental expenses. For salaries, both selling and non-selling, ask your employees how they spend their time. Allocate telephone expense by the number of phones, office supplies by the number of employees, and so on. Beware of using percentage of sales! It’s easy, but rarely does an expense occur on the basis of how much of a particular product or category you’re selling. Let spreadsheet programs, such as Excel, do the calculating for you, and once you have them set up, they’re ready to go with a minimum of tweaking year after year. Here’s an example of a departmental profit and loss statement with overhead allocations:

This example shows a department with a profit, but what if it shows a loss? Should we exit that particular segment of the business? The all-purpose accountant’s answer to that is, “It depends!” If the department is contributing to overhead, it may be worth keeping and adjusting its expenses to a profitable level—perhaps a smaller staff or a small physical footprint to lower its occupancy costs. If, on the other hand, the department has a negative or very low contribution margin, it may be time to rethink that part of your business. Perhaps you could be making more profits by focusing on the departments that are profitable, both from a time and an inventory investment standpoint. The key to all of these decisions is, of course, making sure your allocations are as accurate and fitting as they can be. You will then be on your way to maximizing your profitability.

File Attachments

Join Us in Person for The NAMM Show

With a focus on innovation, the education offerings at The NAMM Show will help to prepare your business for the year to come.

Discover the Benefits of a NAMM Membership

Power our industry’s advocacy efforts by joining the NAMM community, featuring show access, education, discounts, networking, the Global Report and more!